Fast growing economies have positively shown that growth in population is one of the key ingredients for rapid economic growth,in fact, it is unclear how any country can achieve a rapid economic growth rate in foreseeable future without strong population growth.Increase in population provides two major drivers of economic growth; Labor and Market.Without of which any service based economy will never start.

China with 1.3Bn, India 1.2Bn, Nigeria 180Mn , and Ethiopia’s 80Mn are among the countries supporting this school of thought.On the contrary countries with low population growth like Germany and UK have recorded modesty economic growths for the last 3 decades.It is clear that population and economic growth grow in tandem albeit at different rates. The remarkable success of china, india, nigeria and ethiopian economies can be associated with strong population growth.

Yet population growth is problematic if it outpaces increases in productivity.It has been argued that population grows at a geometric rate while resources at an arithmetic rate and increase in population will ultimately surpass the growth in resources. Malthus (1798) claimed that there is a tendency for the population growth rate to surpass the production growth rate because population increases at a geometrical rate while production increases at an arithmetic rate. Thus, the unfettered population growth in a country could plunge it into acute poverty, This has been the case in most underdeveloped countries.

A large population also provides a large domestic market for the economy. Moreover, population growth encourages competition, which induces technological advancements and innovations. Nevertheless, a large population growth is not only associated with food problem but also imposes constraints on the development of savings, foreign exchange and human resources (Meier 1995). Generally, there is no consensus whether population growth is beneficial or detrimental to economic growth in developing economies.

Growing economies need faster growth in population. This leads to increased supply of work force and consumers.

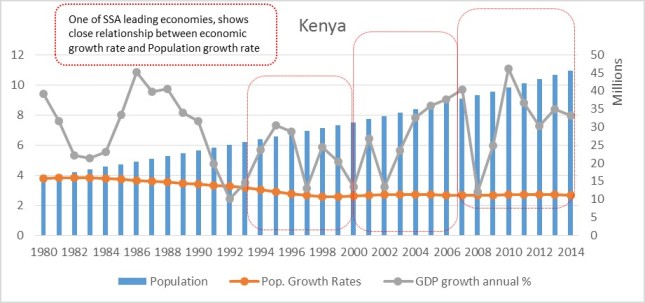

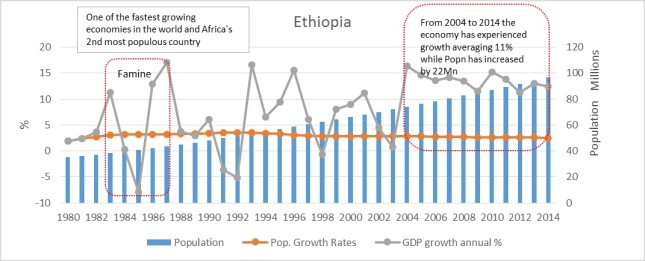

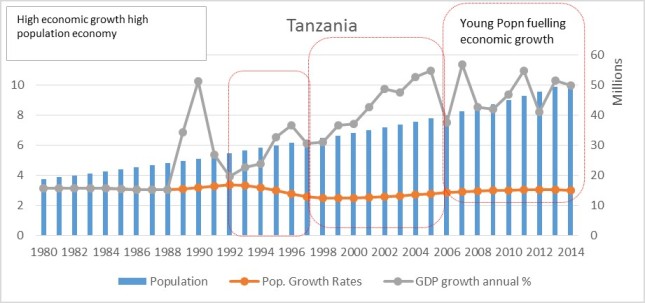

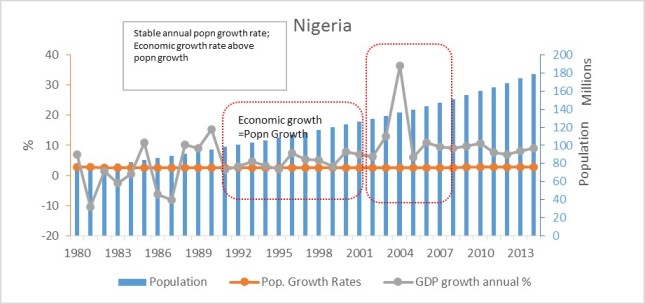

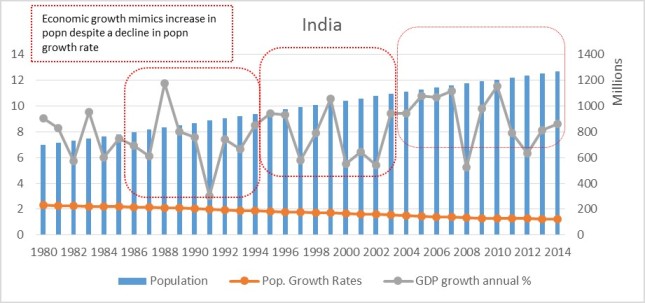

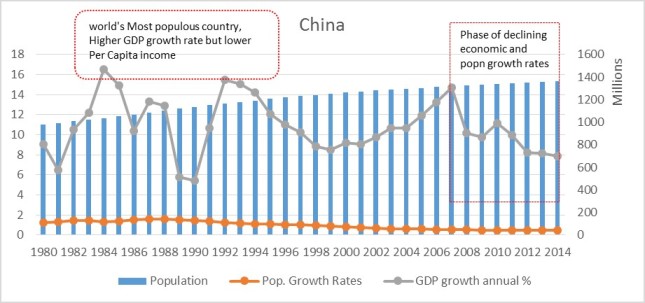

The graphs below show that high population growth is matched by high economic growth for most countries, eliminating the effects of political unsuitability and natural disasters(droughts, famine)

1.Kenya

Kenya’s population growth rate has declined over the years from highs of 4% in early 1980s due to government’s aggressive family planning strategies. The economic growth rate shows a correlation to population growth rate.

2. Ethiopia

One of Africa’s fastest growing economies shows a high correlation between economic growth, population growth rate and the country’s population.

3. Tanzania

4. Nigeria

Africa’s most populous and one of fastest growing population, Nigeria’s population has grown at approximately 3% for the last three decades.

5. India

The link between population growth and economic growth appear to be strong in India

6. China

The population has continued to grow at extremely low rate due to one child policy and aging population. The causes of population aging in China are mainly associated with a low fertility rate, rising life expectancy, and the cumulative effect of past changes in birth and death rates

Studies by early scholars Johansen (1988) and Gregory and Hansen (1996) show that there is no long-run relationship between population and economic growth.Population growth could be beneficial or detrimental to economic growth and economic growth could have an impact on population growth.This however is the proverbial chicken and egg dilemma. What should come first? is it the population or economic growth? and what gives momentum to the other. Yes, increase in population will propel the economy, but what will you feed the population if the economy is poor. Should we first grow the economy (as the proponents of family planning advocate) or should we increase in number and the economy will follow? With all said and done; the argument of population and economic growth will stay with us longer.